If the accounts payable turnover ratio decreases over time, it indicates that a company is taking longer to pay off its debts. This could be due to greater cash flows and better debt management strategies. If the accounts payable turnover ratio increases over time, it indicates that a company is paying off its debts faster than before. This gives greater context to the ratio itself. In that case, some investors may not see this as a viable long-term strategy.Ī better way to use an accounts payable turnover ratio is to examine its change over time. For instance, let’s say a company uses all its cash flow to pay bills instead of diverting a portion of funds toward growth or other opportunities. While this will result in a lower accounts payable turnover ratio, it is not necessarily evidence of shaky finances.įurthermore, a high ratio can sometimes be interpreted as a poor financial management strategy. For example, larger companies can negotiate more favourable payment plans with longer terms or higher lines of credit. Bargaining power also has a significant role to play in accounts payable turnover ratios. However, a low accounts payable turnover ratio does not always signify a company’s weak financial performance. This improves relationships with suppliers and keeps creditors happy. It shows that a company pays its bills frequently. Analyzing Accounts Payable Turnover RatiosĪ higher accounts payable turnover ratio is almost always better than a low ratio. This means that Company A takes roughly 69 days to pay its suppliers. So, the payable turnover in days would be 69.39. To find the average number of days in each payable period, we can use the following formula: To know whether this is a high or low ratio, compare it to other companies within the same industry.

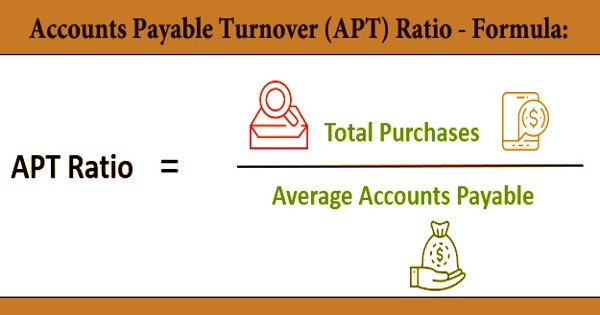

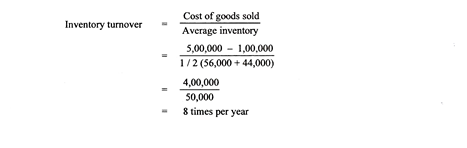

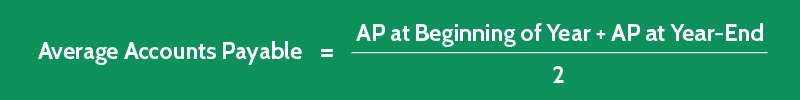

This means that Company A paid its suppliers roughly five times in the fiscal year. So, the accounts payable turnover ratio would be: 5.26 In that case, the calculation would look like this:Īccounts payable turnover ratio = $10 million / (($1.6 million + $2.2 million) / 2) It ended the year with an accounts payable balance of $2.2 million. It began the year with an accounts payable balance of $1.6 million. Payable turnover in days = 365 / Accounts payable turnover ratio Example Calculationįor example, let’s say Company A made $10 million in purchases. Need to find the average number of days in a payable period? Simply divide 365 by the accounts payable turnover ratio. To calculate the average accounts payable, use the year’s beginning and ending accounts payable. Then use the following payable turnover ratio formula:Īccounts payable turnover ratio = Total purchases / Average accounts payable First, divide total purchases by the average accounts payable.

ACCOUNTS PAYABLE TURNOVER RATIO HOW TO

Here’s how to calculate accounts payable turnover ratios. How Do You Calculate Accounts Payable Turnover Ratio? Again, a high ratio is preferable as it demonstrates a company’s ability to pay on time. It provides justification for approving favorable credit terms or customer payment plans. Suppliers also use the accounts payable turnover ratio. So, they should be able to make regular credit interest payments as well.

If the ratio is high, the company can frequently pay its suppliers. Key Takeaways What Is Accounts Payable Turnover Ratio Used For?Ĭreditors use the accounts payable turnover ratio to determine the liquidity of a company. How to Improve Your Accounts Payable Turnover Ratio How Do You Calculate Accounts Payable Turnover Ratio?Īnalyzing Accounts Payable Turnover Ratios What Is Accounts Payable Turnover Ratio Used For? It’s a vital indicator of a company’s financial standing and can significantly impact a company’s ability to secure credit. It’s used to show how quickly a company pays its suppliers during a given accounting period. The accounts payable turnover ratio is a liquidity ratio. Send invoices, track time, manage payments, and more…from anywhere. Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one placeįreshBooks integrates with over 100 partners to help you simplify your workflows Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again

Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

ACCOUNTS PAYABLE TURNOVER RATIO PROFESSIONAL

Wow clients with professional invoices that take seconds to create

0 kommentar(er)

0 kommentar(er)